CapRelo Insider: December 2024

Relocation Tax Implications in 2025

Corporate relocation programs are increasingly complex due to evolving tax laws, especially with the Tax Cuts and Jobs Act (TCJA) set to expire in 2025. Currently, many relocation benefits are considered taxable income, meaning employers must withhold federal, state, and local taxes on these amounts. Additionally, recent changes, such as the National Association of Realtors (NAR) settlement shifting buyer’s agent commissions to employees, add new financial burdens. Employers may need to cover these costs and implement tax gross ups to ensure employees aren’t overwhelmed by tax liabilities.

Strategic relocation planning can help organizations stay compliant while minimizing employee tax burdens. Communicating clearly with employees about these complexities is essential to avoid misunderstandings and maintain satisfaction.

The Impact: Regulations, like the TCJA and shifts in real estate practices, mean relocation benefits must be carefully structured to minimize employees’ tax burdens while staying compliant. To stay ahead, employers should adopt flexible, tech-enabled relocation strategies. Partnering with relocation, tax, and legal experts ensures relocation policies align with current laws and minimize surprises. Transparent communication with employees is just as important, helping them understand tax liabilities and how your company supports them through these challenges.

Program designers should also be mindful that while shifting the tax burden onto employees may reduce program costs, it could also negatively impact the employee experience. Programs with real estate benefits may also consider utilizing the tax protected Buyer Value Option recognized by the Internal Revenue Service.

High Mortgage Rates and Relocation: Supporting Employees Amid Affordability Challenges

Although the Federal Reserve has cut short-term interest rates by three-quarters of a percentage point since mid-September, long-term mortgage and business loan rates have risen during the same period, as reported by Tribune News Service. According to Freddie Mac, 30-year fixed mortgage rates recently averaged 6.8%, higher than before the rate cuts.

Experts highlight that long-term rates are influenced more by economic growth prospects and inflation concerns than by the Fed’s short-term rate cuts. Lara Rhame of FS Investments suggests this divergence signals inflation fears and unchecked government spending. Mortgage banker Michael Kent observed a rise in mortgage inquiries following the presidential election, although housing inventory remains limited.

Mortgage rates may not significantly drop until U.S. Treasury bond yields decline. Adjustable-rate loans could become a popular alternative for buyers anticipating lower rates. Analysts believe a long-term shift toward lower interest rates could happen but not immediately or predictably.

The Impact: Rising long-term mortgage rates impact housing affordability, a key concern for employees relocating for work. These trends also affect the cost of financing homes or business properties, influencing corporate relocation budgets. Mobility leaders may face continued reluctance from relocation candidates as employees face higher borrowing costs. Staying informed on economic indicators like inflation and interest rate trends enables mobility leaders to develop proactive housing policies and provide enhanced financial guidance to relocating employees.

AI and Tax Compliance: Transforming Global Mobility with Efficiency and Insight

According to a recent article from Worldwide ERC’s staff, generative artificial intelligence continues to influence tax compliance within the talent mobility industry. Craig Dexheimer from Global Tax Network and Rajiv Thadani from KPMG highlight AI’s remarkable ability to automate repetitive tasks such as data consolidation, manual entry, and cross-border regulatory tracking. For tax professionals, AI can provide real-time risk assessments, multilingual document processing, and tailored compliance solutions that can quickly adapt to changing international tax laws.

While AI for taxes significantly enhances efficiency and provides analytical insights, human oversight remains essential for nuanced interpretation, validation, and ensuring accuracy. Providers implement policies to protect sensitive employee information and prevent unauthorized data storage. As AI capabilities continue to expand, experts anticipate an incremental integration into existing processes, focusing on augmenting human skills rather than superseding them. This emerging partnership between AI and tax professionals may offer global mobility programs a more sophisticated, efficient approach to navigating the intricate landscape of international tax compliance.

The Impact: For global mobility professionals, AI reduces the burden of manual tasks like data entry, year-to-year tax comparisons, and regulatory monitoring across multiple jurisdictions. It can also help identify anomalies and assess risks in real time to improve compliance in a rapidly shifting global landscape. AI-powered tools can also provide tailored guidance on tax obligations based on employee profiles, answer tax questions, reduce confusion and empower individuals to navigate complex tax systems more confidently.

By combining AI-driven insights with professional judgment, global mobility teams can improve services to better meet the needs of relocating employees while better mitigating risks and ensuring compliance.

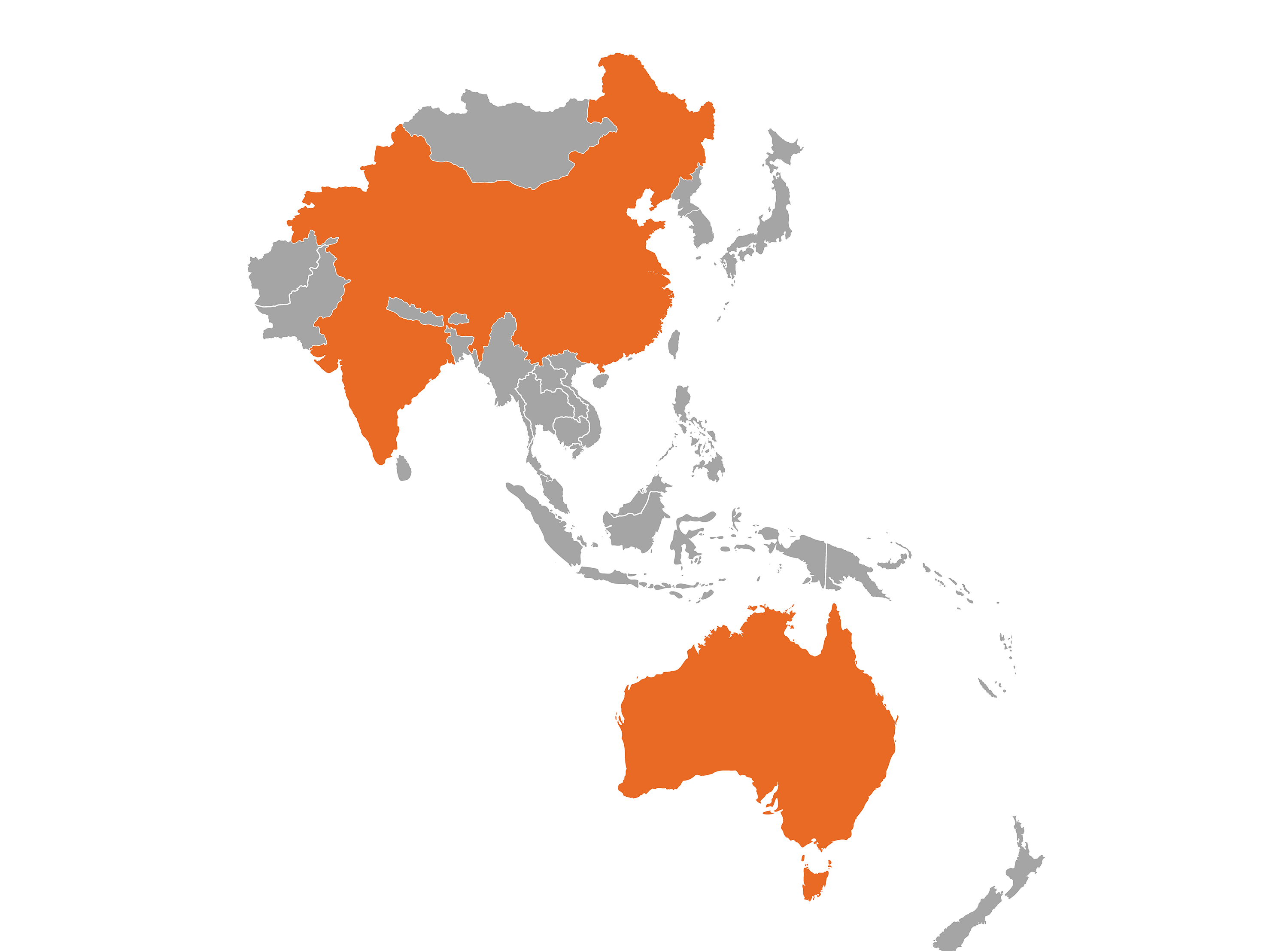

Global Mobility Radar

CapRelo’s Mobility Radar provides valuable insights into trends worth monitoring. This month, we are tracking important global mobility updates in China, India, and Australia.

- Beginning 30 November, China has expanded its visa-free policy to include travelers from nine additional countries, such as Japan, Bulgaria, and Romania. Ordinary passport holders from 38 countries can stay for up to 30 days without a visa. China hopes to encourage tourism, family visits, business travel, and cultural and economic exchanges.

- With geopolitical tensions and rising costs, many businesses are more aggressively pursuing supply chain reshoring and near-shoring strategies. According to Bain & Company’s research, 81% of CEOs plan to diversify their manufacturing base away from traditional hubs and 64% of executives are actively investing in strategies to reduce dependence on foreign manufacturing. The report also highlights a trend toward diversification of manufacturing destinations like Indian subcontinent.

- Australia’s financial regulator, APRA, is maintaining strict home loan serviceability buffers, opting to keep a 3% lending buffer in place amidst a challenging macroeconomic environment. APRA remains cautious of high household debt levels, potential job market instability, and the rising cost of living, looking to protect both permanent residents and prospective homebuyers.